A virtual production LED wall is an advanced digital display system designed to replace traditional green screen environments with high-resolution LED panels that create realistic, dynamic backgrounds in real time. These walls are widely used in XR studios and modern film production facilities because they allow directors, cinematographers, and production teams to interact with photorealistic environments on set instead of relying solely on post-production visual effects. Unlike a standard LED video wall used for commercial advertising or event LED screens, a virtual production LED wall integrates real-time rendering engines, camera tracking systems, and LED display panels to simulate immersive virtual worlds with accurate lighting and depth.

For B2B customers such as film studios, production houses, corporate event organizers, and XR stage operators, the investment in a virtual production LED wall is more than just about image quality. It is about reducing production costs, optimizing workflows, improving collaboration, and offering a long-term solution that aligns with the future of digital content creation. Global LED display manufacturers and LED screen suppliers are already targeting this growing market by offering customized LED display solutions that combine hardware, software, and technical services tailored to the needs of professional production environments.

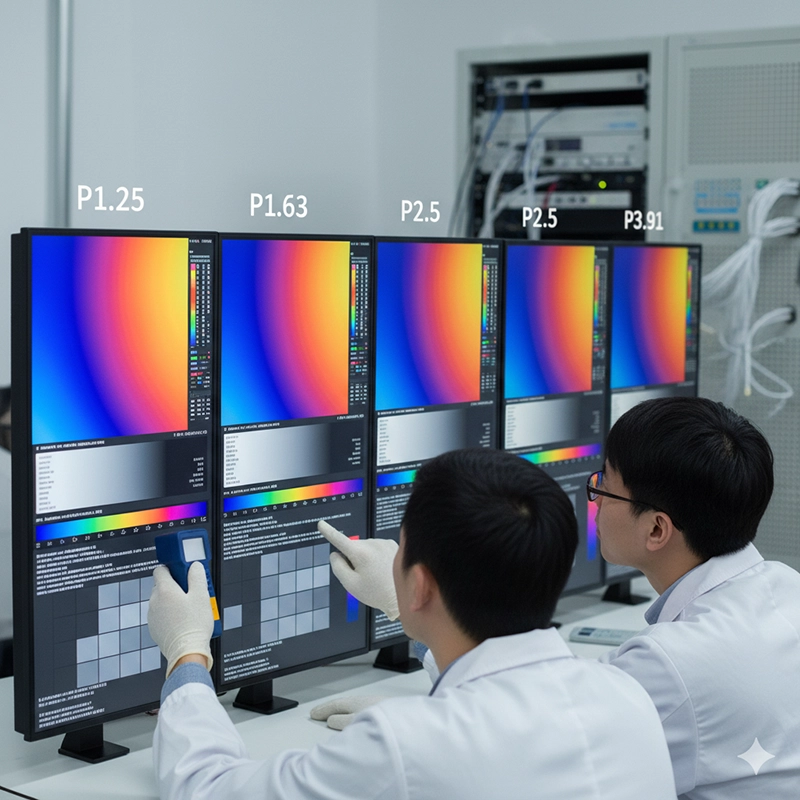

At its core, a virtual production LED wall is built from modular LED display panels arranged to form a massive curved or flat backdrop. Each panel is made of tightly-spaced LED pixels, typically ranging from p1.25 to p3.91 pixel pitch, allowing high-resolution imagery even when the camera is placed close to the wall. A video processor feeds real-time computer-generated graphics into the LED wall, often powered by gaming engines such as Unreal Engine. With camera tracking systems, the virtual background shifts in perspective to match the movement of the camera, creating the illusion of depth and realism.

This combination of LED display technology and real-time rendering allows production teams to capture final-quality shots directly on set, significantly reducing the need for green screen compositing and heavy visual effects in post-production. The difference is especially striking when compared with traditional chroma keying: instead of actors pretending to react to invisible environments, they can physically see and interact with the scene surrounding them.

For B2B decision-makers, such as XR studio developers, film production companies, or rental LED screen providers, understanding the fundamental distinction between LED wall virtual production and conventional backdrops is essential. The technology not only elevates the creative output but also creates new revenue streams by offering immersive studio services for commercials, films, music videos, and corporate presentations.

A typical XR studio equipped with a virtual production LED wall includes several integrated systems:

LED Display Panels – These are the backbone of the setup. Unlike standard commercial LED displays used for retail or outdoor advertising, virtual production walls require LED display panels with high refresh rates, low latency, and accurate color reproduction. Suppliers often recommend custom LED display solutions with pixel pitches tailored to the camera’s resolution and shooting distance.

Real-Time Rendering Engine – Software such as Unreal Engine or Unity generates dynamic 3D environments. These engines process lighting, textures, and motion in real time, ensuring that the background reacts naturally to camera movements.

Camera Tracking System – Infrared markers, sensors, and motion tracking devices are used to align the virtual background with the physical camera. This ensures the perspective looks accurate when the camera pans, tilts, or zooms.

Video Processing Units – Specialized processors manage data flow from rendering engines to LED display screens. They ensure synchronization across all LED display panels, maintain color accuracy, and minimize frame delays.

Lighting Integration – Unlike green screens that require artificial lighting adjustments in post-production, LED walls emit natural light and reflections on actors and objects. This reduces production complexity and creates more realistic results.

For procurement managers or technical directors sourcing LED display solutions, working with an experienced LED display manufacturer is vital. Not every LED screen supplier can deliver panels optimized for virtual production. Factors such as refresh rate (>3,840 Hz), HDR support, brightness consistency, and seamless cabinet alignment play a crucial role in ensuring cinematic quality.

Cost Efficiency in the Long Term Although the initial investment in a virtual production LED wall is high, production studios save significant costs in post-production. Fewer green screen compositing hours are required, and visual effects teams can focus on enhancing rather than building entire environments from scratch.

Improved Creative Flexibility Directors can visualize complex scenes on set, change backgrounds instantly, and experiment with lighting scenarios without leaving the studio. For rental LED screen providers, this flexibility translates into premium rental packages for corporate clients, event organizers, and broadcasters.

Enhanced Actor Performance Actors perform more naturally when immersed in realistic digital environments. This reduces retakes and accelerates shooting schedules, which benefits both the production studio and the clients commissioning the content.

Sustainability and Resource Efficiency Large outdoor shoots often require transportation, logistics, and environmental permits. Virtual production LED walls minimize these demands, enabling companies to reduce carbon footprints while maintaining production quality. This resonates with corporate clients increasingly focused on sustainability.

New Revenue Streams for Studios An XR studio equipped with a virtual production LED wall can rent out its facilities for commercials, live events, or music videos. B2B clients, including advertising agencies, event management firms, and corporate communication teams, are willing to pay premium fees for immersive content solutions.

These benefits make the business case for virtual production LED walls compelling for both large film studios and smaller production houses. For LED display suppliers and manufacturers, this trend opens opportunities to position themselves as long-term partners rather than just hardware vendors.

For procurement managers, understanding the cost structure of a virtual production LED wall is crucial before making purchasing or rental decisions. Several factors influence pricing:

Pixel Pitch and Resolution LED display panels with smaller pixel pitches (such as p1.25 or p1.5) offer higher resolution and better image quality for close-up shots. However, they are more expensive than larger pixel pitch options (p2.5 or p3.91).

Screen Size and Configuration The cost of a virtual production LED wall is directly tied to its dimensions. Large XR stages with curved or ceiling LED panels demand significantly more panels and processing units.

Video Processing and Software Licensing Real-time rendering and high-bandwidth video processing require advanced equipment, often sold as part of a complete LED display solution. Software licenses for Unreal Engine plug-ins or camera tracking systems also add to the budget.

Installation and Calibration Precise alignment and calibration of LED display panels are mandatory for seamless performance. Reputable LED screen suppliers typically include these services in their contracts, but they add to the overall cost.

Maintenance and Support Services Post-installation services such as LED module replacements, firmware updates, and 24/7 technical support are often bundled into service agreements. B2B customers should consider not only the purchase price but also the long-term maintenance cost.

Rental vs Purchase Models For smaller studios or event organizers, rental LED screen solutions may be more cost-effective. Rental LED display manufacturers and suppliers provide flexible packages, allowing clients to scale up or down based on project requirements.

In 2025, the global market trend shows that while hardware costs for LED display panels are gradually decreasing due to mass production, the demand for integrated LED display solutions — including software, installation, and support — continues to rise. For B2B buyers, the most important factor is selecting a supplier who can deliver a complete, future-proof system rather than focusing solely on upfront costs.

Film and Television Feature films, television series, and streaming platforms increasingly adopt LED video walls to create complex environments. The success of productions like The Mandalorian has accelerated industry adoption, with studios worldwide investing in custom LED displays for virtual sets.

Commercials and Advertising Advertising agencies use LED wall studios to shoot commercials with dynamic backgrounds, from cityscapes to exotic locations, without moving production crews across the globe. This trend creates opportunities for LED display manufacturers to collaborate with marketing companies.

Corporate Events and Presentations B2B event organizers are using event LED screens and virtual production LED walls to design immersive brand experiences. Corporate clients can deliver keynote presentations, product launches, or training sessions in virtual environments, maximizing audience engagement.

Music Videos and Live Performances Artists and record labels leverage LED display panels for creative stage design, blending real performances with virtual worlds. Rental LED screen providers offer packages for tours and live shows, targeting both entertainment and corporate clients.

XR Training and Simulation Beyond entertainment, industries such as aerospace, automotive, and healthcare use XR studios for training simulations. For example, automotive companies can showcase new car models in virtual environments without shipping physical prototypes.

By serving such diverse applications, LED screen suppliers and LED display manufacturers establish themselves as strategic partners for clients who demand both creative flexibility and technical reliability.

A virtual production LED wall is an advanced digital display system designed to replace traditional green screen environments with high-resolution LED panels that create realistic, dynamic backgrounds in real time. These walls are widely used in XR studios and modern film production facilities because they allow directors, cinematographers, and production teams to interact with photorealistic environments on set instead of relying solely on post-production visual effects. Unlike a standard LED video wall used for commercial advertising or event LED screens, a virtual production LED wall integrates real-time rendering engines, camera tracking systems, and LED display panels to simulate immersive virtual worlds with accurate lighting and depth for B2B use cases.

At its core, a virtual production LED wall is built from modular LED display panels arranged to form a massive curved or flat backdrop. Each panel is made of tightly spaced LED pixels, typically ranging from p1.25 to p3.91 pixel pitch, allowing high-resolution imagery even when the camera is placed close to the wall. A video processor feeds real-time computer-generated graphics into the LED wall, often powered by rendering engines. With camera tracking systems, the virtual background shifts in perspective to match the movement of the camera, creating the illusion of depth and realism.

This combination of LED display technology and real-time rendering allows production teams to capture final-quality shots directly on set, significantly reducing the need for chroma key compositing and heavy visual effects in post-production. The difference is especially striking when compared with traditional green screen workflows: instead of actors pretending to react to invisible environments, they can physically see and interact with the scene surrounding them.

For B2B decision-makers such as XR studio developers, film production companies, or rental LED screen providers, understanding the fundamental distinction between LED wall virtual production and conventional backdrops is essential. The technology elevates creative output and creates new revenue streams by offering immersive studio services for commercials, films, music videos, corporate presentations, and training content.

Virtual production calls for LED display panels with high refresh rates, low latency, and precise color calibration. Compared with standard commercial LED displays used for retail or outdoor led display advertising, these systems emphasize cinematic performance, seamless cabinet alignment, and robust processing.

Engines generate dynamic 3D environments and process lighting, textures, and motion in real time so the background reacts naturally to camera movements.

Markers, sensors, and motion tracking align the virtual background with the physical camera to preserve perspective when the camera pans, tilts, or zooms.

Specialized processors manage data flow from rendering engines to LED display screens, synchronize panels, maintain color accuracy, and minimize frame delays.

LED walls emit natural light and reflections on actors and objects, reducing production complexity and delivering realistic on-set results.

For procurement teams sourcing LED display solutions, partner with an experienced led display manufacturer that understands virtual production tolerances, including high refresh rates, HDR capability, and uniform brightness.

Ensure the led screen supplier can provide turnkey integration with rendering, camera tracking, processing, and calibration services.

Cost efficiency over time: capturing final-pixel imagery on set reduces post-production hours and reshoots, improving project margins for B2B clients.

Creative flexibility: directors can visualize complex scenes on set and change backgrounds instantly, enabling premium rental led screen packages and custom led display configurations.

Enhanced actor performance: immersion improves realism, reduces retakes, and accelerates schedules for studios and corporate commissioners.

Sustainability: fewer location moves and logistics lower emissions while maintaining quality, aligning with enterprise ESG goals.

New revenue streams: XR studio owners can rent facilities for commercials, live events, corporate presentations, and training productions.

These benefits make a strong business case for both large film studios and smaller production houses. For LED display suppliers and manufacturers, the shift enables positioning as long-term partners offering comprehensive led display solutions rather than one-off hardware sales.

Pixel pitch and resolution: smaller pitches such as p1.25 or p1.5 increase quality for close-ups but raise cost versus p2.5 or p3.91 options.

Screen size and configuration: larger curved stages and ceiling panels require more cabinets and processing capacity.

Video processing and software: high-bandwidth processors, licenses, and camera tracking add to total cost of ownership.

Installation and calibration: precision mechanics and color calibration are essential and should be included in supplier scope.

Maintenance and support: service contracts, spare modules, firmware updates, and 24/7 technical support impact lifecycle cost.

Rental versus purchase: rental led display packages reduce upfront capex for smaller studios and events, while direct purchase suits frequent utilization.

Hardware prices for led display panels continue to decline gradually, but integrated solutions that bundle software, installation, training, and service are rising in demand. B2B buyers should aim for a future-proof system and evaluate partners on integration capability and long-term support.

Film and television: large-scale scenes and environments captured in camera increase realism and compress timelines.

Commercials and advertising: rapid background iteration allows agencies to deliver more concepts without location moves, leveraging led video wall assets.

Corporate events and presentations: event led screens and XR stages create immersive keynotes, product launches, and training sessions.

Music videos and live performance: creative stage designs blend physical performance with virtual worlds using modular led display panels.

XR training and simulation: aerospace, automotive, and healthcare deploy virtual sets for simulation and instruction without moving prototypes.

By serving diverse applications, led screen suppliers and led display manufacturers position themselves as strategic partners for clients who demand both creative flexibility and technical reliability.

High initial investment: building a professional XR stage with quality led display panels, processors, tracking, and rendering requires significant capex.

Technical complexity: operation demands skilled engineers in LED, video processing, camera tracking, and real-time rendering.

Space requirements: large walls require structural support, floor loading, and adequate ventilation.

Heat and power: high-brightness panels consume energy and produce heat, necessitating efficient cooling and power planning.

Maintenance dependence: frequent calibration and service are required compared with simpler commercial led displays.

Initial investment — LED wall: high and scalable; Green screen: lower setup cost.

Post-production workload — LED wall: reduced through final-pixel capture; Green screen: extensive compositing required.

Actor immersion — LED wall: high with visible environments; Green screen: low with blank backgrounds.

Lighting integration — LED wall: realistic reflections and lighting; Green screen: artificial, adjusted in post.

Flexibility on set — LED wall: instant scene changes and real-time updates; Green screen: requires new plates or locations.

Operational complexity — LED wall: specialized LED and XR expertise; Green screen: familiar to most crews.

Long-term ROI — LED wall: strong for studios with multi-client pipelines; Green screen: depends on external VFX capacity.

MicroLED integration for higher brightness, finer pitch, and longer lifespan in close-up cinematography.

Transparent led screen modules layered into XR sets for augmented visual effects and creative composition.

Higher dynamic range and color accuracy with advanced calibration workflows and AI-assisted correction.

Global expansion of XR studios across film hubs and regional markets with custom led display solutions.

Growth of rental led screen offerings that provide scale without ownership for events and short projects.

Hybrid applications that repurpose infrastructure for both entertainment and corporate communications.

AI-enhanced production that accelerates scene generation, camera alignment, and optimization.

Experience in virtual production with reference installations in XR and film studios.

Customization capability for pixel pitch, brightness, curvature, and cabinet mechanics.

Service and maintenance contracts that include calibration, spare parts, and rapid response.

Integration expertise to deliver turnkey led display solutions with processors and camera tracking.

Scalability and future-proofing for upgrades such as MicroLED, HDR, and transparent modules.

Upfront cost — Manufacturer purchase: higher capex; Rental provider: lower opex.

Customization — Manufacturer: full custom led display options; Rental: limited to inventory.

Support and warranty — Manufacturer: long-term replacement and warranties; Rental: support bundled during rental term.

Use case — Purchase: long-term studio utilization; Rental: short-term events or pilot productions.

ROI potential — Purchase: higher for frequent use and asset resale; Rental: flexibility for irregular demand.

Indoor led display installations for corporate lobbies, exhibitions, and client showcases leveraging the same panels.

Outdoor led display campaigns with billboards and stadium perimeter screens to extend studio assets into marketing.

Event led screens for brand activations, conferences, and live broadcasts as an additional revenue stream.

Transparent led screens for retail and automotive showrooms, aligning physical spaces with virtual storytelling.

Modular led display panels enabling expansion, reconfiguration, and continuous optimization without starting over.

A virtual production LED wall is an advanced digital display system designed to replace traditional green screen environments with high-resolution LED panels that create realistic, dynamic backgrounds in real time. These walls are widely used in XR studios and modern film production facilities because they allow directors, cinematographers, and production teams to interact with photorealistic environments on set instead of relying solely on post-production visual effects. Unlike a standard LED video wall used for commercial advertising or event LED screens, a virtual production LED wall integrates real-time rendering engines, camera tracking systems, and LED display panels to simulate immersive virtual worlds with accurate lighting and depth.

For B2B customers such as film studios, production houses, corporate event organizers, and XR stage operators, the investment in a virtual production LED wall is more than just about image quality. It is about reducing production costs, optimizing workflows, improving collaboration, and offering a long-term solution that aligns with the future of digital content creation. Global LED display manufacturers and LED screen suppliers are already targeting this growing market by offering customized LED display solutions that combine hardware, software, and technical services tailored to the needs of professional production environments.

At its core, a virtual production LED wall is built from modular LED display panels arranged to form a massive curved or flat backdrop. Each panel is made of tightly spaced LED pixels, typically ranging from p1.25 to p3.91 pixel pitch, allowing high-resolution imagery even when the camera is placed close to the wall. A video processor feeds real-time computer-generated graphics into the LED wall, often powered by gaming engines such as Unreal Engine. With camera tracking systems, the virtual background shifts in perspective to match the movement of the camera, creating the illusion of depth and realism.

This combination of LED display technology and real-time rendering allows production teams to capture final-quality shots directly on set, significantly reducing the need for green screen compositing and heavy visual effects in post-production. The difference is especially striking when compared with traditional chroma keying: instead of actors pretending to react to invisible environments, they can physically see and interact with the scene surrounding them.

For B2B decision-makers, such as XR studio developers, film production companies, or rental LED screen providers, understanding the fundamental distinction between LED wall virtual production and conventional backdrops is essential. The technology not only elevates the creative output but also creates new revenue streams by offering immersive studio services for commercials, films, music videos, and corporate presentations.

A typical XR studio equipped with a virtual production LED wall includes several integrated systems:

LED display panels optimized for virtual production with high refresh rates, low latency, and accurate color reproduction; often part of a custom LED display solution tuned to the camera’s resolution and shooting distance.

Real-time rendering engines (e.g., Unreal Engine) that generate dynamic 3D environments, lighting, and textures synchronized with camera movement.

Camera tracking systems using markers and sensors to align on-screen perspective with physical camera motion for convincing parallax and depth.

Video processing units maintaining synchronization across LED display panels, preserving color accuracy, and minimizing frame delays.

Lighting integration that leverages the LED wall’s emitted light for natural reflections and shadows, reducing post-production adjustments.

For procurement managers sourcing LED display solutions, partnering with an experienced LED display manufacturer is vital. Not every LED screen supplier can deliver panels optimized for virtual production. Specifications such as refresh rate (>3,840 Hz), HDR support, brightness consistency, and cabinet alignment play decisive roles in achieving cinematic results.

Cost efficiency over time: capturing final-quality shots on set reduces compositing hours and shifts VFX toward enhancement rather than reconstruction.

Creative flexibility: directors can iterate environments and lighting instantly; rental LED screen providers can bundle premium services for corporate and broadcast clients.

Enhanced performance: actors respond to visible environments, reducing retakes and accelerating schedules.

Sustainability: fewer location moves, lower logistics, and reduced carbon footprint while maintaining production quality.

New revenue streams: XR studios can rent the LED volume to agencies, brands, and music producers, monetizing idle time and broadening client portfolios.

Pixel pitch and resolution: smaller pixel pitches (p1.25–p1.5) cost more but enable close-up cinematography; larger pitches (p2.5–p3.91) suit wider shots.

Screen size and configuration: large curved stages and LED ceilings increase panel counts and processor capacity requirements.

Processing and software licensing: real-time rendering pipelines and camera tracking add to TCO beyond the LED display panels.

Installation and calibration: precision alignment, seam control, and color calibration are specialized services often bundled by the LED screen supplier.

Maintenance and support: module replacement, firmware updates, and 24/7 support must be factored into multi-year budgets.

Rental vs purchase: rental LED display solutions reduce CapEx for smaller studios and event organizers while enabling scale-on-demand.

In 2025, hardware prices continue to decrease gradually, but demand for integrated LED display solutions—hardware, software, engineering, and service—keeps overall project budgets solution-centric. B2B buyers benefit most by selecting future-proof systems rather than optimizing for the lowest upfront price.

Film and television: large LED video walls enable photorealistic virtual sets and consistent lighting.

Commercials and advertising: agencies switch environments in minutes, shortening production cycles and tailoring content to each market.

Corporate events: event LED screens and virtual production pipelines elevate keynotes, product launches, and branded communications.

Music and live performance: creative blends of transparent LED screens and backdrop walls deliver immersive stages.

XR training and simulation: aerospace, automotive, and healthcare deploy controlled, repeatable scenarios for safety and product training.

High initial investment: LED display panels, processors, and engines require significant CapEx compared with conventional studios.

Technical complexity: skilled LED/XR engineers are essential for planning, operation, and maintenance.

Space requirements: structural loads, viewing distances, and ventilation must be engineered from the outset.

Heat and power: high-brightness panels drive cooling and energy needs that affect OpEx and sustainability metrics.

Service dependence: frequent calibration and support contracts are critical to uptime and image quality.

Initial investment: LED wall is high but scalable; green screen is lower cost.

Post-production workload: LED wall reduces compositing; green screen requires extensive keying and CG integration.

Actor immersion: LED wall provides real environments; green screen is abstract and less intuitive.

Lighting integration: LED wall delivers natural reflections; green screen needs post adjustments.

On-set flexibility: LED wall enables instant scene changes; green screen depends on prebuilt plates.

Operational complexity: LED wall needs XR technicians; green screen fits conventional crew skills.

Long-term ROI: LED wall strong for multi-client studios; green screen ROI depends on VFX outsourcing.

MicroLED adoption: higher brightness, longer lifespan, and finer pitch for camera-critical work.

Transparent LED screens: layered visuals and mixed-reality effects for retail and XR stages.

HDR and color science: cinema-grade calibration, HDR10+, and AI-driven color correction.

Global XR studio expansion: increasing investments across the US, Europe, and Asia.

Growth of rental models: rental LED screen packages for tours, events, and pilot projects.

Hybrid applications: leveraging indoor and outdoor LED displays with the same production pipeline.

AI-enhanced production: automated background generation and smarter camera-tracking workflows.

Virtual production experience: proven XR/film installations over generic commercial LED displays.

Customization capability: bespoke pixel pitch, brightness, and curvature configurations.

Service and maintenance: 24/7 support, spares strategy, and calibration services in writing.

Integration expertise: turnkey LED display solutions including processors, engines, and tracking.

Scalability: clear upgrade paths to MicroLED, higher refresh, and transparent LED modules.

Upfront cost: manufacturer (CapEx, high); rental provider (OpEx, low).

Customization: manufacturer (full custom LED displays); rental (inventory-bound).

Support & warranty: manufacturer (extended, direct); rental (period-limited but included).

Use case fit: manufacturer for permanent XR stages; rental for short-term events and pilots.

ROI potential: manufacturer high for frequent use; rental flexible for variable demand.

Indoor LED displays: reuse panels for corporate lobbies, demo zones, and trade shows.

Outdoor LED displays: extend capabilities to billboards, stadium perimeters, and campaigns.

Event LED screens: brand activations, product launches, and executive summits.

Transparent LED screens: showrooms and retail windows with layered, dynamic content.

LED display modules: modular growth paths for future screen size and format changes.

Flagship sci-fi series: a large LED volume replaces green screen to capture photorealistic environments in-camera, cutting location moves and stabilizing lighting.

European studios: adoption of indoor LED displays configured as permanent XR stages that can also be rented to agencies and independent producers.

Automotive launches: custom LED display stages render global landscapes for localized campaigns without shipping prototypes worldwide.

Technology keynotes: LED video walls power synchronized, data-rich backdrops tightly integrated with live demos.

Concert tours: rental LED screen packages combine transparent LED and backdrop walls for immersive shows.

Esports arenas: high-refresh custom LED displays ensure broadcast-grade motion and low latency.

Differentiate with premium virtual production capabilities.

Monetize through studio rental to third-party productions.

Maintain controlled environments that reduce schedule and weather risks.

Switch environments in minutes for rapid creative iteration.

Offer clients multi-market content with localized backgrounds.

Leverage commercial LED displays skill sets to transition into XR.

Deliver high-impact product launches with interactive digital sets.

Run immersive training and safety simulations.

Elevate executive communications with branded virtual spaces.

Deploy transparent LED screens and custom LED displays in showrooms.

Unify brand storytelling across XR stages and physical retail.

Reuse LED display panels to optimize lifecycle ROI.

Match pixel pitch to camera distance and shot type (close-up vs wide).

Clarify content categories: cinematic, corporate, or advertising.

Choose ownership vs rental based on utilization models.

Prioritize LED display manufacturers with XR references.

Request live demos and contactable client references.

Confirm turnkey integration capabilities.

Pixel pitch ranges and color performance guarantees.

Customization levels and mechanical tolerances (seams, curvature).

Service SLAs, spare strategy, and response times.

CapEx vs OpEx balance and financing options.

Maintenance: module replacement, calibration, firmware.

Operations: energy and HVAC costs.

Training: XR operator upskilling and team structure.

Upgrade: pathways to MicroLED, higher refresh, HDR.

Treat suppliers as solution partners for continuous improvement.

Plan joint roadmaps for feature updates and expansions.

Co-market case studies to drive studio utilization.

Price-only decisions: low-cost panels may miss refresh, latency, or color targets.

Infrastructure gaps: ignoring structure, rigging, and HVAC escalates costs later.

Weak service terms: inadequate support jeopardizes uptime and client delivery.

No scalability plan: failing to plan upgrades forces premature replacement.

The LED display market is expanding steadily, with virtual production among its fastest-growing applications. For B2B buyers, supplier competition increases choice while integrated LED display solutions become the dominant engagement model. Corporate clients increasingly prefer partners who deliver complete systems—LED display panels, processors, software, and ongoing service—over one-off hardware purchases. Vendors who can span event LED screens, indoor LED displays, outdoor LED displays, and transparent LED screens within a unified ecosystem will secure durable competitive advantage.

The global market for virtual production LED walls is poised for significant growth. Analysts forecast that the industry will expand at double-digit rates over the next five years as studios, corporations, and event organizers increasingly recognize the value of immersive content creation. Several key factors drive this momentum and shape how B2B buyers evaluate an LED display solution for long-term value and cross-sector utilization.

The market trajectory reflects converging forces: higher content demand, steady declines in component costs from leading LED display manufacturers, and rapid innovation in real-time rendering. Custom LED display configurations and rental LED screen offerings are broadening adoption beyond film and television into corporate communications, retail, education, sports, and live entertainment.

Content explosion across platforms: Streaming, social advertising, and corporate communications require faster, higher-quality production. Virtual production LED walls accelerate time-to-market while maintaining cinematic fidelity.

Declining hardware costs: Mass production and competition among LED display manufacturers are gradually reducing the price of LED display panels and processors, lowering the barrier to entry for regional studios and corporate clients.

Technological innovation: Finer pixel pitch options, higher refresh rates, HDR capability, and improved color calibration make virtual sets viable for close-up shots and complex lighting. Curved volumes and ceiling panels enable flexible custom LED display layouts.

Corporate adoption: B2B use cases—product launches, executive briefings, training, and brand storytelling—extend demand beyond entertainment, creating steady utilization for suppliers offering integrated LED display solutions.

A virtual production LED wall is capital intensive, but it can outperform traditional workflows over a multi-project horizon. The following considerations help procurement teams and studio executives quantify returns and align the investment with revenue operations.

Reduced production costs: Fewer location moves, lower logistics spend, and less post-production compositing. Savings compound across multiple shows, ads, or corporate campaigns.

Increased studio utilization: An XR stage becomes a revenue center by renting space to filmmakers, agencies, and event organizers, supported by rental LED screen packages.

Shortened production timelines: Final-quality shots are captured in camera. Faster cycles translate into more projects per year and stronger cash flow.

Brand differentiation: Studios and LED screen suppliers that deliver advanced virtual production services win higher-value B2B engagements versus commodity commercial LED displays.

Long-term asset value: Modular LED display panels can be repurposed for indoor LED displays, outdoor LED displays, or event LED screens, preserving value as needs evolve.

Upfront costs: Virtual production LED wall requires higher CapEx in displays, processors, and tracking; traditional relies on moderate spend for locations and green screens.

Recurring costs: Virtual production emphasizes maintenance, energy, and software; traditional bears travel, logistics, and extended post-production.

Time-to-market: Virtual production is faster due to in-camera finals; traditional is slower and heavily VFX-dependent.

Revenue potential: Virtual sets open incremental studio rental and turnkey LED display solution services; traditional tends to be one-project focused.

Scalability: Virtual volumes are modular and expandable; traditional is constrained by location availability and logistics.

Organizations that treat the LED volume as a platform—rather than a single-purpose product—maximize utilization and ROI. The same infrastructure that powers a film shoot can support enterprise communication, retail experiences, or sports entertainment.

Use case: Keynotes, product launches, investor days, internal training with branded environments.

Technology: Event LED screens integrated with custom LED display backgrounds synchronized to live demos.

Benefit: Higher audience engagement and message clarity while suppliers expand into corporate communications.

Use case: Universities and vocational programs in film, broadcasting, visualization, and simulation.

Technology: Indoor LED displays reconfigured as practical learning stages with real-time rendering.

Benefit: Hands-on skills development and institutional leadership in emerging media production.

Use case: Transparent LED screens and glass-like displays for product storytelling and seasonal campaigns.

Technology: Repurpose virtual production LED display panels into commercial LED displays for immersive showrooms.

Benefit: Unified brand narrative across media and in-store environments with efficient asset reuse.

Use case: Stadium perimeter LED displays, halftime performances, esports staging, broadcast backdrops.

Technology: Outdoor LED display systems combined with virtual backgrounds for seamless live and on-air experiences.

Benefit: Enhanced fan engagement, sponsor activations, and flexible programming.

As B2B demand matures, LED display manufacturers and system integrators are shifting from hardware sales to solution partnerships. Buyers increasingly evaluate suppliers on service depth, integration capability, and roadmap transparency.

Turnkey solutions: Panels, processors, camera tracking, and real-time engines delivered as one integrated LED display solution with single-point accountability.

Customization expertise: Curved volumes, LED ceilings, fine pixel pitches, and hybrid sets with transparent LED screens tailored to camera and staging constraints.

Global service networks: Regional parts depots, certified field engineers, and 24/7 support for multinational B2B clients.

R&D investment: A visible roadmap for MicroLED, HDR workflows, advanced calibration, and volumetric display experimentation.

Direct manufacturer: Produces LED display panels and sells directly to film studios and large corporations seeking ownership and deep customization.

System integrator: Combines displays with software, tracking, and control systems for turnkey delivery aimed at mid-sized production houses.

Rental LED screen provider: Supplies temporary volumes and event LED screens for tours, conferences, and pilots where OpEx is preferred.

Hybrid partner: Offers both sales and rental, plus training, maintenance, and upgrade paths for corporate clients with mixed usage.

Think ecosystem, not product: Position the LED volume alongside indoor LED displays, outdoor LED displays, event LED screens, and transparent LED screens for unified ROI.

Prioritize service agreements: SLAs for uptime, calibration, and spare modules are essential for time-critical productions.

Invest in training: Build internal capability on LED display solutions and real-time engines or secure supplier-led certification.

Plan for scalability: Choose modular LED display panels and processing that support future pixel pitch upgrades and software advances.

Leverage cross-sector opportunities: Repurpose the infrastructure for corporate, retail, and education to smooth utilization and accelerate payback.

Growth outlook: Double-digit CAGR projected through 2030, led by expanding XR demand and broader B2B adoption of commercial LED displays.

Regional dynamics: Asia-Pacific accelerates on content production and corporate deployment; North America and Europe remain strong due to established film hubs and enterprise budgets.

Supplier implication: Intensifying competition favors partners that combine manufacturing strength with integration, rental flexibility, and global service.

A successful virtual production LED wall program follows a structured, low-risk path from discovery to steady-state operations. Treat the wall as a long-lived platform composed of LED display panels, processing, tracking, and content pipelines—not a single purchase.

Define use cases across film/TV, corporate events, training, and retail cross-overs to maximize utilization.

Establish business metrics: utilization hours per month, target time-to-market reduction, revenue from third-party studio rentals, and acceptable payback window.

Map stakeholders and roles (production, engineering, finance, procurement, legal, HSE) to ensure alignment on requirements and compliance.

Specify pixel-pitch bands for camera distances (e.g., p1.25–p1.5 for close-ups; p2.5–p3.91 for mid/long shots).

Define performance targets: refresh ≥3,840 Hz, low-latency pipeline, HDR capability, ΔE color thresholds, brightness uniformity, seam tolerances, cabinet flatness.

Plan infrastructure: power distribution, thermal management, rigging and load paths, floor loading, cable runs, RF/EMC considerations.

Validate room geometry for curved or hybrid layouts (main wall + portals + ceiling, or volumes with transparent LED screen elements).

Shortlist at least three partners: an LED display manufacturer, a system integrator, and a rental LED screen provider for supplemental capacity.

Run a camera test with your lenses, sensors, and codecs; evaluate moiré, color rendition, rolling-shutter artifacts, tracking stability.

Stage a mini-shoot (one day) with real content to vet workflows, storage throughput, and real-time scene changes.

Accept panels by lot with QA: dead-pixel thresholds, uniformity maps, calibration reports, cabinet alignment measurements.

Commission processors, sync, genlock, and camera tracking; validate perspective shifts and parallax under controlled moves.

Lock SOPs for power-up, health checks, calibration intervals, and emergency procedures.

Track core KPIs such as uptime, end-to-end latency, color accuracy, uniformity, utilization hours, and revenue per hour; iterate weekly.

Build a backlog of scenes/environments tied to revenue opportunities (film bookings, corporate launches, training programs).

Expand to additional volumes or add indoor/outdoor LED display configurations for hybrid uses when utilization justifies.

A virtual production LED wall transforms how film studios, XR stages, and enterprises create and deliver content. For B2B buyers, the business case extends beyond image quality: it is a platform that compresses timelines, expands revenue options, and integrates with indoor LED display, outdoor LED display, event LED screens, and transparent LED screen deployments across the organization. The most reliable path to value is systematic: define goals, specify requirements, trial with your cameras and workflows, select a supplier ecosystem, and operationalize with measurable KPIs. With modular LED display panels, robust processing, disciplined calibration, and service-first partnerships, the virtual production LED wall becomes a durable asset—ready to evolve through new pixel pitches, HDR pipelines, and real-time engines while supporting a growing mix of creative and commercial use cases.

— End of article —

Hot Recommendations

Hot Products

Get a Free Quote Instantly!

Talk to Our Sales Team Now.

If you are interested in our products, please contact us promptly

Reach out to our sales team to explore customized solutions that perfectly meet your business needs and address any questions you may have.

Email Address:info@reissopto.comFactory Address:Building 6, Huike Flat Panel Display Industrial Park, No. 1, Gongye 2nd Road, Shiyan Shilong Community, Bao'an District, Shenzhen city , China

whatsapp:+8615217757270