LED display manufacturers in 2025 are playing a central role in the transformation of visual communication, entertainment, advertising, and public information systems. With technological innovation accelerating and global supply chains adapting to new demands, manufacturers are tasked with delivering solutions that meet increasingly diverse application requirements. From indoor conference halls to outdoor stadiums, from transparent glass walls in retail stores to rental LED screens at global music festivals, the demand for LED displays has become not only a matter of technological preference but also a key factor in business strategy and procurement decisions.

This comprehensive report explores the global insights of LED display manufacturers in 2025, highlighting market trends, regional distribution, technological advancements, OEM and ODM opportunities, supply chain challenges, pricing considerations, and practical buyer guidelines. While numerous companies compete in this highly fragmented market, the emergence of integrated brands—such as Reissopto—demonstrates how manufacturers can combine research, development, production, and international distribution into a cohesive industry approach.

The LED display manufacturing ecosystem can be divided into three major layers:

Component suppliers – including LED chip producers, driver IC developers, and PCB module suppliers.

Manufacturers and assemblers – factories that design, produce, and assemble LED display panels, cabinets, and modules.

System integrators and distributors – companies that customize solutions for end-users across industries.

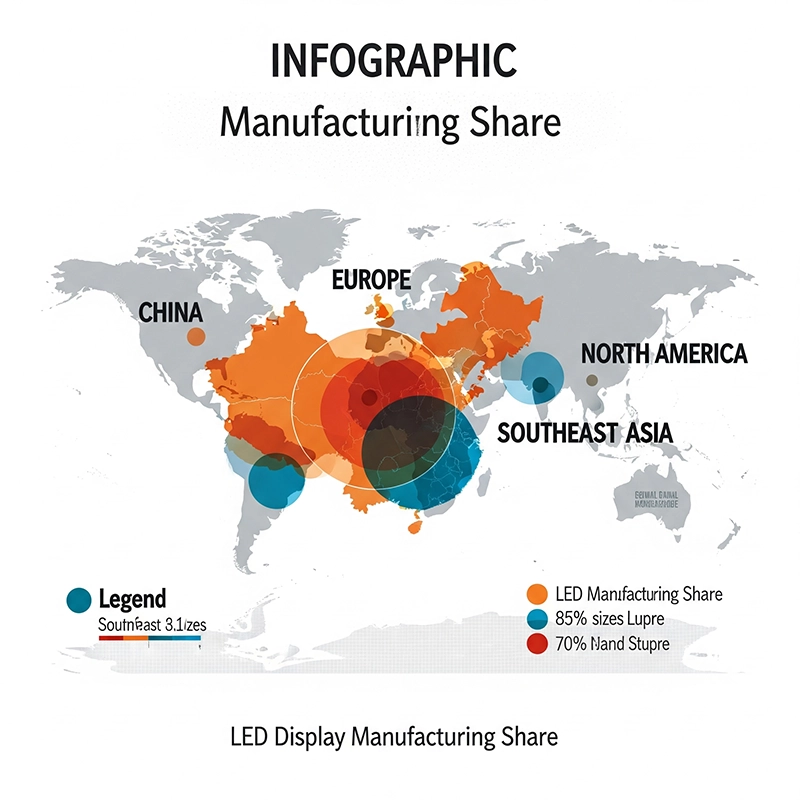

In 2025, the global LED display market is valued at more than USD 16 billion, with projections indicating steady growth at a compound annual growth rate (CAGR) of 7–8% over the next five years (Statista, 2025). Asia-Pacific dominates the production base, accounting for nearly 70% of global output, primarily led by China. Europe and North America contribute smaller but higher-value segments, specializing in premium technology such as micro LED, transparent LED screens, and volumetric LED walls used in advanced entertainment and medical visualization.

China: The undisputed global hub, hosting more than 60% of LED display factories. Offers competitive prices, massive production capacities, and strong OEM/ODM customization capabilities.

Europe: Focused on high-end architectural LED displays, transparent technologies, and regulatory compliance with CE and RoHS standards.

North America: Specializes in large-scale stadium screens, cinema-grade LED walls, and film production environments such as XR studios.

Southeast Asia: Emerging manufacturing base with growing export activities, particularly Vietnam and Malaysia.

The year 2025 marks a transition point for LED display technology. Market researchers highlight four primary trends shaping procurement and innovation:

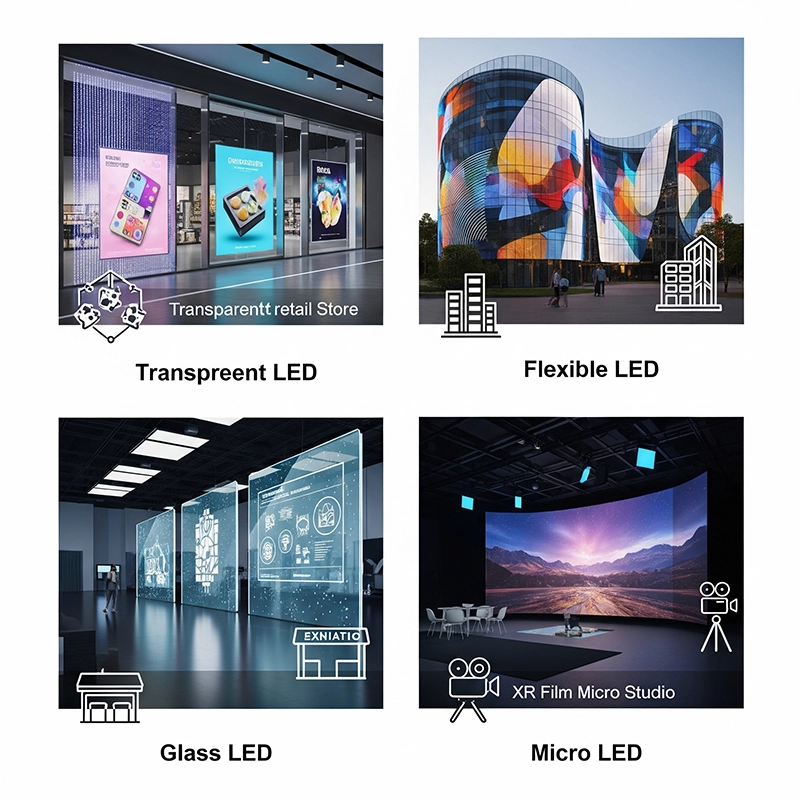

Micro LED Displays – Considered the future of LED technology, micro LED offers extremely fine pixel pitches, unmatched brightness, low power consumption, and longer lifespans. Adoption remains limited due to high costs but is expanding in premium indoor video walls and high-end applications.

Volumetric Displays and Virtual Production – The film industry increasingly uses LED walls for virtual sets. According to LEDinside (2024), over 120 new XR studios opened globally in the past two years, fueling demand for advanced volumetric displays.

Transparent LED Screens – Used in retail shopfronts, museums, and airports, transparent LED combines visibility with digital signage. Manufacturers are investing in thinner, more flexible modules with higher transparency ratios.

Flexible LED Displays – Event organizers and creative industries demand flexible, curved, and foldable LED panels to design immersive environments.

Indoor LED Display: 40% market share, growing steadily due to demand from retail, education, and corporate users.

Outdoor LED Display: 35% market share, still dominant for advertising, stadiums, and public infrastructure.

Rental LED Display: 15% share, experiencing rapid growth in entertainment and events.

Specialty Displays (Transparent, Flexible, Micro LED): 10% share, fastest-growing category.

Indoor LED display manufacturers focus on pixel density, image fidelity, and seamless integration. With pixel pitches ranging from P0.9 to P4.0, indoor LED displays compete directly with LCD and OLED in conference rooms, airports, and shopping centers.

Retail Advertising: Indoor LED walls enhance the shopping experience, showcasing products dynamically.

Corporate Communication: Conference rooms increasingly rely on LED video walls for presentations and hybrid meetings.

Educational Institutions: Universities and schools deploy LED displays in lecture halls and auditoriums.

Worship Centers: Church LED displays create impactful environments for services, events, and community gatherings.

Manufacturers serving this sector must provide advanced calibration, high refresh rates (>3840 Hz), and integration with AV systems. Buyers often prioritize indoor LED display manufacturers with ISO certifications and after-sales service networks.

Outdoor LED displays remain a cornerstone of global visual communication. With pixel pitches typically from P6 to P16, these displays emphasize brightness (≥6000 nits), weather resistance (IP65+), and robust structural design.

Billboards and Advertising Screens: Cities around the world invest in digital out-of-home (DOOH) advertising.

Stadium Display Solution : LED perimeter displays, scoreboards, and large-format video walls enhance fan engagement.

Smart City Infrastructure: Displays integrated into traffic management and public safety systems.

Raw Materials: LED chips and driver ICs account for 40% of costs.

Labor and Assembly: Regional differences lead to cost disparities of 15–20%.

Logistics: Shipping large panels increases procurement costs by 10–15%, especially across continents.

Energy Costs: Rising electricity prices affect production and end-user operating expenses.

China continues to dominate outdoor LED display production, but buyers in Europe and North America are increasingly sourcing from regional suppliers to reduce logistics and compliance risks.

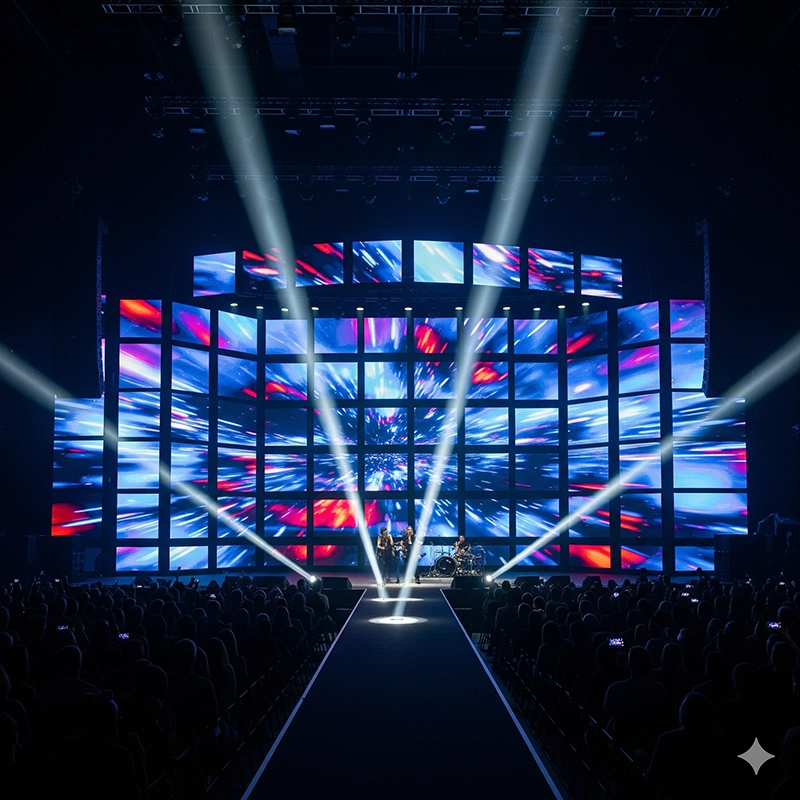

The rental LED screen industry is growing at over 12% CAGR, driven by live events, exhibitions, and global festivals. Rental LED display manufacturers must design products that are lightweight, modular, and easy to install.

Concerts and Festivals: Stage LED screen rental offers scalable, high-impact visual effects.

Corporate Exhibitions: Rental LED display provide flexibility and easy installation for B2B trade fairs.

Private Events: Wedding LED screens and celebration backdrops are emerging as niche markets.

Buyers looking for a rental LED display manufacturer should evaluate fast installation systems, high refresh rates for live broadcasting, and flexible pixel pitch options (P2.5, P3.91, P4.8).

Technological innovation is at the heart of competitiveness. Manufacturers differentiate themselves by investing in R&D for transparent, flexible, and micro LED technologies.

| Technology Type | Applications | Cost Level | Average Lifespan | Supplier Availability |

|---|---|---|---|---|

| Transparent LED display | Retail storefronts, museums, airports | High | 60,000 hours | Limited, growing |

| Flexible LED display | Event staging, creative architecture | Medium | 50,000 hours | Widely available |

| Glass LED screen | Luxury showrooms, exhibitions | High | 55,000 hours | Limited suppliers |

| Micro LED panels | Premium indoor walls, XR film studios | Very High | 100,000 hours | Early adoption stage |

Innovators, including Reissopto, are contributing to the adoption of transparent and flexible LED display technologies, enabling new creative applications while maintaining reliable quality standards.

Innovators, including Reissopto, are contributing to the adoption of transparent and flexible LED display technologies, enabling new creative applications while maintaining reliable quality standards.

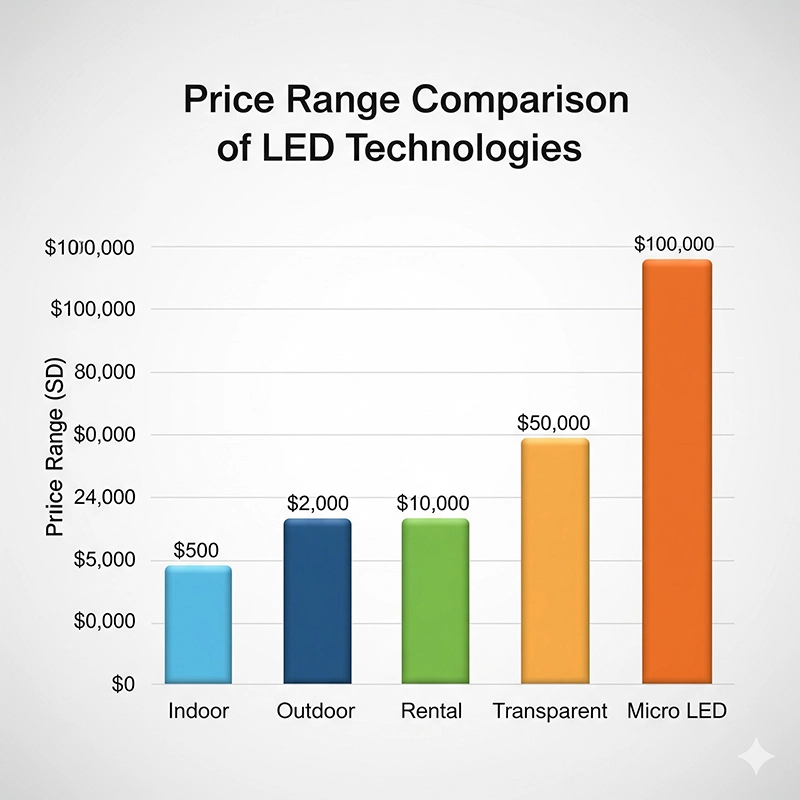

Pricing for LED displays in 2025 depends on pixel pitch, display size, technology type, and supplier location. Buyers must evaluate not just the upfront cost but also lifecycle expenses such as energy consumption, maintenance, and spare part replacement.

Pixel Pitch: Smaller pitch (P1.2–P2.5) → higher cost due to more LEDs per panel.

Display Size: Larger projects cost more proportionally, both in modules and infrastructure.

Application Type: Outdoor displays are more expensive due to brightness and weatherproofing.

Technology: Transparent and micro LED are premium, while standard indoor/outdoor panels are more affordable.

Supplier Region: Chinese factories = competitive prices; European/US = higher due to labor and compliance.

| LED Display Type | Typical Pixel Pitch | Price Range (per m²) | Notes |

|---|---|---|---|

| Indoor LED Display | P1.2 – P4.0 | USD 800 – 2,500 | Retail, corporate, education |

| Outdoor LED Display | P6 – P16 | USD 900 – 3,500 | Billboards, stadiums |

| Rental LED Display | P2.5 – P4.8 | USD 1,200 – 3,000 | Lightweight, modular |

| Transparent LED Display | P3.9 – P7.8 | USD 2,500 – 6,000 | Retail shopfronts, airports |

| Micro LED Display | P0.9 – P1.5 | USD 6,000 – 15,000+ | XR studios, premium walls |

Buyer Considerations on Pricing

Buyer Considerations on PricingLifecycle Cost: Cheap options may lead to higher long-term expenses.

Maintenance Contracts: Service packages can offset repair and downtime costs.

Customization: OEM/ODM services often add to cost but provide differentiation.

Energy Efficiency: Newer LEDs save operational costs.

OEM and ODM partnerships define the strategic direction of many B2B buyers.

OEM (Original Equipment Manufacturer): Buyers maintain brand control while outsourcing manufacturing.

ODM (Original Design Manufacturer): Manufacturers design and deliver complete LED solutions to buyers.

OEM/ODM agreements are critical in reducing time-to-market and ensuring product differentiation. Large manufacturers in China dominate this segment, but international buyers are also diversifying partnerships to Southeast Asia and Eastern Europe.

Customization of cabinet sizes and pixel pitches.

Integration with specific software and content management systems.

Branding flexibility for wholesalers and distributors.

For B2B buyers, choosing the right supplier involves a rigorous procurement process.

Certifications & Standards: CE, RoHS, FCC, ISO 9001 ensure safety and quality compliance.

Lifecycle Costing: Compare upfront costs with lifespan and maintenance requirements.

After-Sales Service: Availability of spare parts, remote support, and on-site maintenance.

Technology Readiness: Manufacturers with roadmaps for micro LED and transparent LED adoption offer long-term value.

Customer References: Case studies, testimonials, and proven projects demonstrate reliability.

The global LED display industry in 2025 balances mass-market cost efficiency with cutting-edge innovation. Indoor, outdoor, rental, and specialty displays all demonstrate unique growth patterns, while OEM/ODM partnerships give buyers more flexibility than ever before.

Manufacturers that combine large-scale production capacity with a commitment to R&D are best positioned to thrive in the coming decade. For buyers, choosing reliable partners is critical to ensuring quality, durability, and long-term return on investment. Integrated brands like Reissopto, alongside other global players, illustrate the industry’s future: a blend of customization, innovation, pricing transparency, and global distribution that continues to redefine the visual communication landscape.

According to IEEE Spectrum (2024), advances in micro LED efficiency and transparent display technologies are expected to reduce operational costs by more than 15% within five years. Meanwhile, LEDinside Market Report (2025) projects that global LED display demand will surpass 20 million square meters annually, reflecting the expanding role of manufacturers in both commercial and public applications. These findings reinforce the importance of aligning procurement strategies with trusted suppliers who are prepared for long-term market shifts.

Hot Recommendations

Hot Products

Get a Free Quote Instantly!

Talk to Our Sales Team Now.

If you are interested in our products, please contact us promptly

Reach out to our sales team to explore customized solutions that perfectly meet your business needs and address any questions you may have.

Email Address:info@reissopto.comFactory Address:Building 6, Huike Flat Panel Display Industrial Park, No. 1, Gongye 2nd Road, Shiyan Shilong Community, Bao'an District, Shenzhen city , China

whatsapp:+8615217757270